If you’re looking to take a business loan, knowing what factors matter most to best nationwide banks before they offer financing can be helpful. Different lenders will look at different things when deciding whether or not they’ll give business money, but there are some commonalities across the board.

Small business lines of credit as financial solutions are a popular form of business financing that many lenders consider favorably. They offer businesses a flexible source of funds, allowing them to draw on the credit line as needed, making them an attractive option for managing cash flow and addressing short-term financial needs.

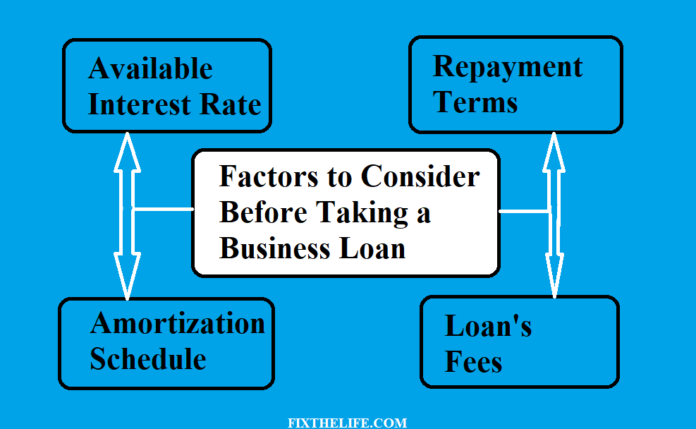

Here are four key factors that all lenders consider:

Available Interest Rate

The interest rate is the amount of money paid in exchange for borrowing money. It’s a percentage of the amount borrowed, so it varies depending on how much you borrow. The interest rate is determined by the supply and demand for loans, which are affected by several factors like economic conditions and inflation.

Suppose you’re looking at taking out small business loans from a bank or credit union, or any other financial institution. In that case, one thing you should do before making that commitment is to find out what kind of interest rate your potential lender will be charging on your loan. Lantern by SoFi states, “Small business loans are used to purchase equipment or expand to any new locations.”

You should know this because every dollar counts when it comes to running your business; every dollar may mean another hour worked or another product sold, or both!

ALSO READ: How To Start An eCommerce Business?

Repayment Terms

Repayment terms are the length of time it will take you to pay back the money you’ve borrowed. Your repayment term can be anywhere from 1 year to 10 years, depending on how much money you borrow, your credit score and other factors.

The longer the repayment term, the higher your monthly payments will be—but this also means that you’ll pay less in interest overall since more of your payment goes toward paying off principal instead of interest over time.

ALSO READ: Personal Loans with Zero Credit Check: Buyer Beware

Amortization Schedule

If a business loan seems like too much of a burden to bear, you may get some relief by looking into an amortization schedule. This plan shows how much money you will be paying back on the loan.

As with any financial decision, it’s important to know exactly how much you’ll have to pay each month and what the total cost of your loan will be over time.

An amortization schedule will help you understand these things so that if taking out a business loan is right for your business needs, you’ll know what kind of payments are ahead of you.

ALSO CHECK: Everything Related to Financial Advice and loans.

Loan’s fees

The second thing to consider is the fees you will pay. These are usually based on your loan amount, so the higher your borrowing need, the more you will pay in fees. The most important question is: How much interest can you afford? The interest rate for a business loan varies widely depending on factors such as your credit score and company size.

Generally speaking, a small business owner with good credit might expect to pay between 6% and 10% interest on their loan—but again, this depends on other factors as well (the term of repayment).

So, there you have it. These are the four things you’ll need to consider before taking a business loan. If you keep these in mind when comparing offers or signing on the dotted line, then hopefully, you’ll be able to make an informed decision that works best for your business!

ALSO READ: How to Compare Student Loan Rates?

Conclusion

Make sure to remember these 4 Key Factors to Consider Before Taking a Business Loan. Also check the Small Business Lending Survey (SBLS) 2022 to know every details how banks process loan

ALSO READ: How Transferring Money Between Banks Helps the Economy?