What is the Difference Between a Will and a Living Trust?

The key differences between wills and living trusts are how they can be managed and what they can include. Wills and living trusts are both important estate planning tools that are used to protect and distribute assets to loved ones after death. However, they have distinct differences in terms of what they can include, how they’re managed, and when they take effect.

Wills are legal documents that take effect after an individual’s death and specify how their property and assets will be distributed among beneficiaries. The question arises which is better for you – Living Trust vs. Will.

They need to go through the probate process, becoming a matter of public record, and assets must be in the testator’s name when they die.

On the other hand, trusts are legal arrangements that become effective upon their creation and allow individuals to transfer property and assets to designated beneficiaries while still alive. They bypass probate, and there is no requirement to file a trust, so they remain private.

To choose the best option for your scenario, it is important to understand the key differences between wills and trusts and consider the specific goals, assets, and family dynamics you wish to address.

In this article we have covered several aspects on wills versus trusts.

What is a will?

A will is a legal document that outlines the distribution of an individual’s assets after death, including money, personal property, and real estate.

It specifies who will inherit the assets, known as beneficiaries, and the person or entity responsible for managing the distribution of the assets called the executor or personal representative.

Additionally, a Will can also include provisions such as naming guardians for minor children, granting power of attorney, and outlining end-of-life healthcare decisions.

What is a Living Trust?

A living trust is a legal arrangement where assets, such as money or property, are held in trust for the benefit of a designated beneficiary or beneficiaries.

The assets are managed by a trustee and can be distributed either at the grantor’s death or at a predetermined date chosen by the grantor.

Unlike a will, a living trust can provide for distributions to be made during the grantor’s lifetime, at death, or even at a later time. It also avoids probate and remains private, unlike a Will, which becomes a matter of public record when submitted for probate.

ALSO READ: Download the QUITCLAIM DEED From Here

How Are Living Trusts And Wills Different?

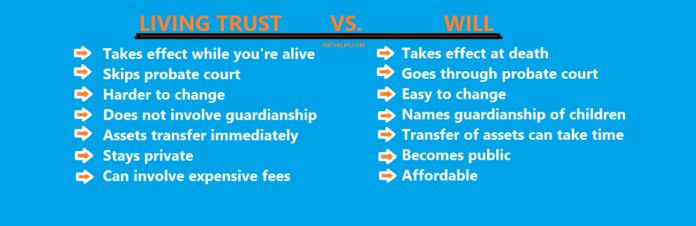

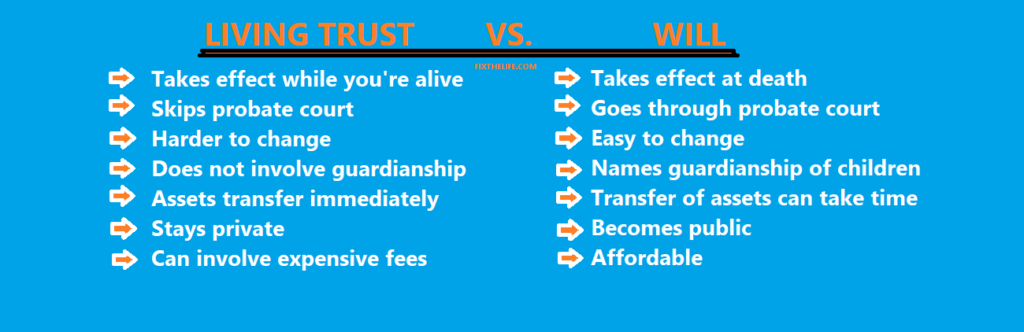

The key differences between wills and living trusts are how they can be managed and what they can include. Wills and living trusts are two different estate planning tools that serve different purposes. A will primarily deal with the distribution of assets after an individual’s death and does not hold assets during the individual’s lifetime.

On the other hand, a living trust holds assets during the individual’s lifetime. It provides instructions for how they should be managed and distributed, which can be done during the grantor’s lifetime or at a predetermined date.

Another key difference is that wills are subject to the probate court, which means that the court has the final say in the distribution of assets.

In contrast, a living trust typically allows the grantor to bypass probate court and have more control over the distribution of assets.

However, Will provide the opportunity to name a guardian for any minor children or dependents, designate power of attorney, and outline end-of-life wishes that a living trust does not.

Wills vs. Living Trusts Cheat Sheet

Wills and trusts are both important estate planning tools, but they serve different purposes and have different features. As a result, it can take time to understand the differences between them.

When choosing between a will or a trust, it is important to consider your individual needs, goals, and assets. You can also use both in your estate plan to ensure that all your assets and wishes are considered.

It is always advisable to consult with a legal professional and check your state’s laws to ensure that your estate plan complies with them.

| Wills | Trusts | |

| Is it active while you are still alive? | NO | YES |

| Can you add a beneficiary? | YES | YES |

| Is it subject to estate tax? | YES | YES, Except it is an irrevocable trust. |

| Is it subject to probate court? | YES | NO |

| Is is compulsory to be notarized? | YES | NO |

| Is there a requirement of witnesses? | YES | NO |

| Can I decide the end-of-life wishes? | YES | NO |

| Can I name a guardian? | YES | NO |

| Is it a public record? | YES | NO |

Living Trust vs. Will – Which One is Better For You?

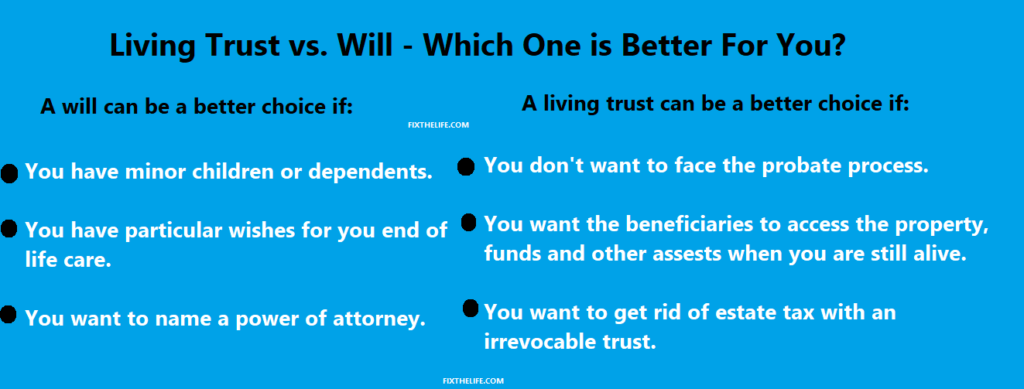

When considering whether to use a living trust or a will as part of your estate plan, it is important to determine what is most important for yourself, your loved ones, and your specific needs. This will help you decide which option is the best fit for you.

A will can be a better choice if:

- You have minor children or dependents.

- You have particular wishes for you end of life care.

- You want to name a power of attorney.

A living trust can be a better choice if:

- You don’t want to face the probate process.

- You want the beneficiaries to access the property, funds and other assets when you are still alive.

- You want to get rid of estate tax with an irrevocable trust.

In some cases, a will and a living trust may be the best option. It depends on your specific circumstances and goals. It is always recommended to consult with an estate planning lawyer, who can help you determine which option is the best fit for your life and provide guidance on how to proceed.

Frequently Asked Questions

Q: What are the disadvantages of a living trust?

ANS: No asset protection: A revocable living trust does not provide asset protection from creditors and requires significant administrative work, such as transferring ownership of assets to the trust. Any assets that are not transferred will have to go through probate.

Q: Why trust is better than a will?

ANS: A living trust is active immediately after it is created and funded, unlike a will that only goes into effect after death. This means that a trust can provide protection and manage assets if the grantor becomes incapacitated, a capability that a will does not possess.

Q: What are three advantages of a living trust in comparison to a will?

ANS: Compared to a will, the main benefits of a revocable living trust are the avoidance of probate and the facilitation of a smoother, faster, and more cost-effective transfer of assets to beneficiaries.

Q: What are the disadvantages of putting your house in a trust?

ANS: Placing a house in a trust can offer benefits such as bypassing probate court, reducing estate taxes, and potentially shielding the home from certain creditors. However, disadvantages include the expense of creating the trust and the required documentation.

I hope now you are clear on the subject Living Trust vs. Will and what are their differences.