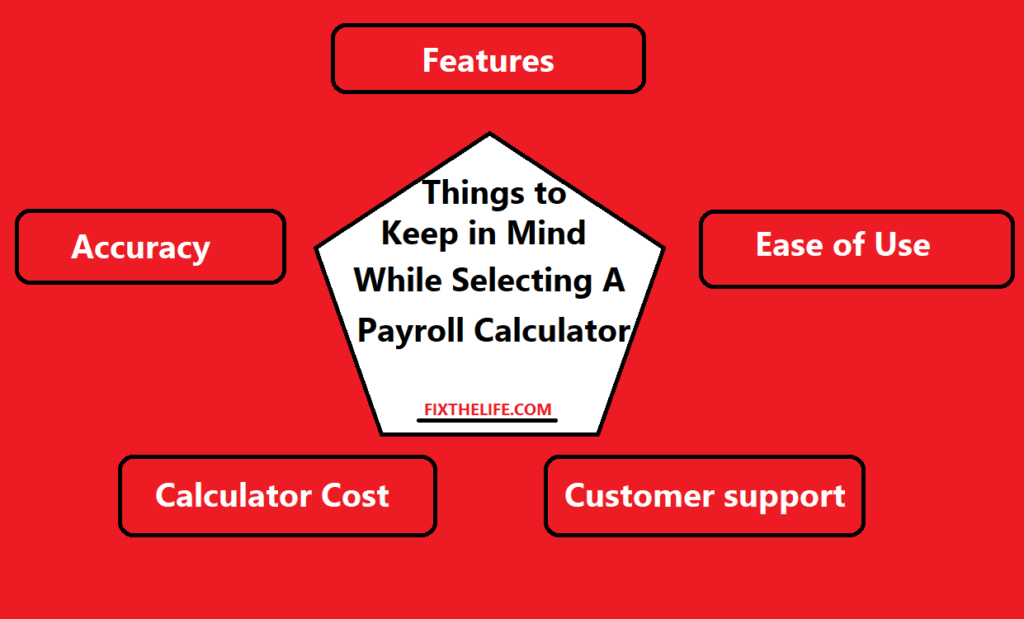

Learn what to look for when selecting a payroll calculator, including accuracy, ease of use, features, cost, customer support, and an hourly paycheck calculator. Also, consider if the software includes a paycheck calculator Maryland feature.

When choosing a payroll calculator, it’s also important to consider whether the software includes an hourly paycheck calculator. This feature allows employers to calculate pay for hourly employees accurately. Ensuring that the software can handle different hourly rates, overtime, and other factors that can affect an employee’s pay is vital.

The hourly paycheck calculator saves time and makes sure the numbers are correct, making it an important tool for businesses with hourly workers. By having a paystub creator with an hourly paycheck calculator, employers can ensure that their employees are paid correctly and on time.

1. Accuracy

Accuracy is one of the most important things to consider when selecting a payroll calculator. Inaccurate payroll calculations can lead to problems with the government, unhappy employees, and legal issues. Therefore, it is essential to choose a payroll calculator that is known for its accuracy.

Before making a decision, research the company and its payroll calculator. Look for reviews and testimonials from other users to see how accurate they have found the software. Additionally, consider the level of support that the company offers

2. Ease of use

Another important factor to consider is the ease of use of the payroll calculator. Ideally, the software should be intuitive and user-friendly.

You don’t want to waste time figuring out how to use the software or spend hours on training. Instead, the payroll calculator should be easy to navigate, with clear instructions and a straightforward interface.

To determine the ease of use of a payroll calculator, look for demos or free trials that allow you to test the software.

During this trial period, please pay attention to how easy it is to input employee information, calculate payroll, and generate reports. If you need clarification on the software, your business may have better options.

ALSO READ: CBD Payment Processor Highriskpay.com – Everything You Need to Know

3. Features

Payroll calculators can vary greatly in the features they offer. Some may only calculate basic payroll, while others include additional features such as time and attendance tracking, tax compliance, and employee self-service portals.

When choosing a payroll calculator, you should consider what features are most important for your business.

Make a list of the features that are important to you, such as automatic tax calculation, direct deposit, and year-end reporting.

Then, compare the payroll calculators you are considering to see which ones offer those features. Remember that the more features a payroll calculator has, the more expensive it may be. Therefore, you should prioritize the most important features of your business.

4. Cost

How much a payroll calculator costs depends on how many features it has and how big your business is. Some payroll calculators charge a monthly fee, while others charge per employee or payroll run.

When comparing the prices of different payroll calculators, you should look at the one-time cost and any fees that will keep coming up.

It is also important to consider the value you get for your money. A more expensive payroll calculator may offer additional features or better support, which can be worth the extra cost.

Additionally, consider the potential costs of inaccurate payroll calculations, such as legal fees or fines, when evaluating the cost of a payroll calculator.

5. Customer support

Also, when choosing a payroll calculator in Maryland, think about how many ways there are to contact customer services, such as by phone, email, or chat. That can be helpful if you have questions or concerns about the software.

Consider the level of support that the company offers. Is a dedicated support team available to assist you, or will you be directed to a general help desk? How quickly do they respond to inquiries? Is support available during your business hours?

Wrapping up

If you want accurate and timely payroll processing for your business, you need to choose the right payroll calculator. When comparing payroll calculators, you should consider how accurate they are, how easy they are to use, their features, how much they cost, how good their customer service is, and if they have an hourly paycheck calculator. The best option, however, is Netchex. It’s easy to use and comes with abundant advanced features.

ALSO READ:

WHAT IS SDDFCU? How to Login and Create SDFCU