Planning for the future can be hard, so let us make it easier for you. If you’re thinking about making a plan for after you die or want to check if the plan you have is good, this guide can help explain the difference between wills and trusts. If you need help or have questions on how the wills and trusts differ, don’t hesitate to contact us for a free first talk.

What are The Basic Work of Wills and Trusts?

WILL

A will is a legal document specifying how a person’s assets and property will be distributed upon death. It directs who will inherit the individual’s possessions.

TRUST

A trust is a legal arrangement where a designated trustee holds and manages assets and property on behalf of the beneficiaries designated by the grantor. The trustee is responsible for distributing income to the chosen beneficiaries per the trust’s terms.

Wills and trusts are both legal tools for estate planning that allow individuals to make decisions about the distribution of their assets, property, and even custody of children after their death. Wills and trusts have unique benefits and drawbacks, but a comprehensive estate plan typically includes both a will and a trust to ensure the fullest possible protection of the estate.

ALSO READ: Living Trust and A Will – Which is Better for You?

When Do the Wills and Trusts Takes Effect?

WILL

A will is a legal document that takes effect after an individual’s death and specifies how their property and assets will be distributed among beneficiaries.

TRUST

A trust is a legal arrangement that becomes effective upon its creation and allows an individual to transfer property and assets to designated beneficiaries while they are still alive.

One of the key benefits of using a trust is its flexibility regarding when property and assets can be distributed. Unlike a will, a trust can provide for distributions to be made during the grantor’s lifetime, at death, or even later, providing the flexibility that a will cannot match.

Difference Between Will and Trusts When it Comes to Property Inheritance

WILL

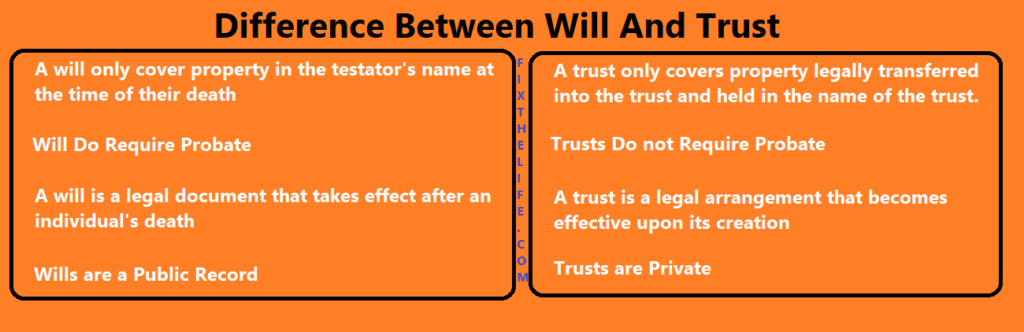

A will only cover property in the testator’s name at the time of their death. If an individual does not own the property, they cannot transfer it through a will, except in certain circumstances.

TRUST

A trust only covers property legally transferred into the trust and held in the name of the trust. It does not cover property that an individual continues to own in their name.

ALSO READ: Free Download the Quitclaim deed form here.

Wills and Trusts – How the Mental Disability Affects Them?

WILL

A will only take effect after the testator’s death; as such, it is not impacted by any mental disability or incapacitation that the testator may experience during their lifetime.

TRUST

Certain types of trusts, such as revocable living trusts, can have provisions for disability or incapacitation that take effect immediately after they are signed. This enables the transfer of property and assets while the grantor is still alive.

Will Do Require Probate But Trusts Do not Require Probate

WILL

A will requires that property and assets go through the probate process before they can be transferred to the beneficiaries named in the will. This means that a court must first validate the will and then oversee the assets’ distribution according to the will’s terms.

TRUST

Property and assets placed in a trust bypass the probate process. Because the assets are already legally transferred to the trust, there is no need for the court to validate the trust and oversee the distribution of assets, meaning the process is faster and more private.

Wills are a Public Record But Trusts are Private

WILL

A will becomes a matter of public record when submitted to the court for the probate process. This means that the will contents and the distribution of the asset are accessible to anyone who wants to view the records.

TRUST

There is no legal requirement to file a trust with the court, so trusts remain private, and the details of the trust and the distribution of assets are known only to those involved in the trust.

Difference Between Will And Trust