Savings accounts are a great way to save and grow your money, but not all are created equal. High-yield savings accounts offer significantly higher interest rates than traditional ones, allowing you to earn more on your money. In this article, you’ll explore high-yield savings accounts and how you can take advantage of them to grow your savings faster.

What is a High-Yield Savings Account?

A high-yield savings account is a type of savings account that offers a higher interest rate compared to traditional savings accounts. The interest rate is typically variable, which means it can change over time, but it is usually higher than the average savings account interest rate.

ALSO READ: CBD Payment Processor Highriskpay.com – Everything You Need to Know

Advantages of High-Yield Savings Accounts

There are several advantages to using a high-yield savings account to grow your money. Firstly, they offer a higher interest rate, allowing you to earn more on your money over time. This can help you reach your savings goals faster. Secondly, high-yield savings accounts are FDIC-insured, meaning your money is protected by up to $250,000 in case of a bank failure.

How to Find the Best High-Yield Savings Account in 2023

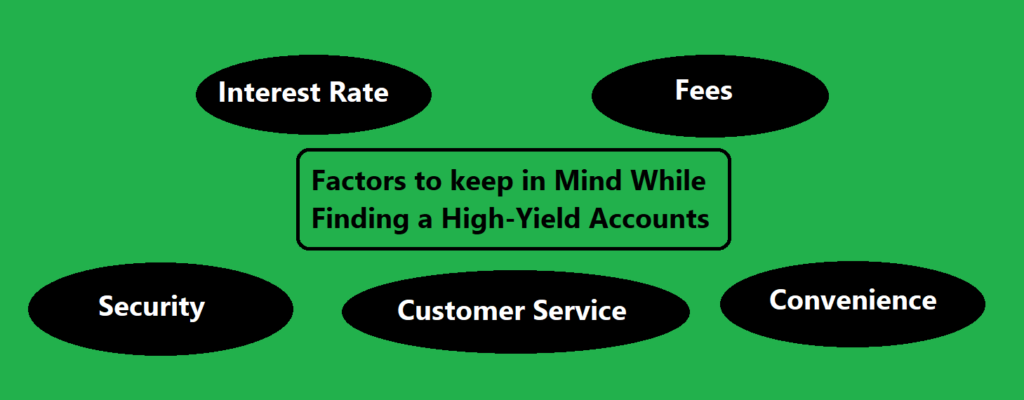

Finding the best high-yield savings account in 2023 for your needs can be challenging, but with a little research, you can find one that meets your needs and helps you reach your savings goals. “Lantern by SoFi has helped search some of the best providers and the rates they currently offer.” Here are some things to consider when looking for a high-yield savings account:

- Interest Rate: Compare the interest rates offered by different high-yield savings accounts to find the one that offers the highest rate. Keep in mind that interest rates can change over time, so it’s important to check regularly.

- Fees: Look for a high-yield savings account that has low or no fees. Some accounts may have maintenance fees, minimum balance fees, or transaction fees, which can eat into your savings.

- Convenience: Consider the accessibility of your savings account, including online and mobile banking, ATM access, and branch locations.

- Customer Service: Look for a high-yield savings account that offers good customer service and support in case you need assistance with your account.

- Security: Choose an FDIC-insured high-yield savings account with strong security measures in place to protect your money.

Tips for Maximizing Your Savings

Once you have found a high-yield savings account that meets your needs, there are several things you can do to maximize your savings:

- Automate your savings: Set up automatic monthly transfers from your checking account to your high-yield savings account to help you save consistently.

- Take advantage of promotions: Some high-yield savings accounts offer promotional interest rates for new customers. Take advantage of these promotions to earn even more money.

- Regularly review your account: Regularly check your high-yield savings account to ensure you earn the highest interest rate possible. If interest rates have increased, consider moving your money to a new account offering a higher rate.

High-yield savings accounts are a great way to earn more on your money and reach your savings goals faster. By comparing interest rates, fees, convenience, customer service, and security, you can find the best high-yield savings account for your needs. You can maximize your savings by automating your savings, taking advantage of promotions, and regularly reviewing your account.

ALSO READ: Why Do Retailers Choose High-Risk Merchant Accounts Offshore?