Life insurance is a crucial component of financial planning, offering numerous benefits to individuals and their families. For example, having a life insurance policy can provide peace of mind, knowing that your loved ones will be protected in the event of your death. In this article, they will discuss the benefits of a life insurance policy, including a million-dollar life insurance policy.

1. Death Benefit

The primary purpose of life insurance is to provide a death benefit to the policyholder’s beneficiaries in the event of their death. This benefit can help cover expenses such as funeral costs and outstanding debts or provide financial support for the family.

The death benefit can be used to pay for the costs associated with end-of-life expenses, helping to ease the financial burden on loved ones during difficult times.

With a million dollar life insurance policy, the death benefit can be substantial, providing significant financial support for your loved ones.

2. Living Benefits

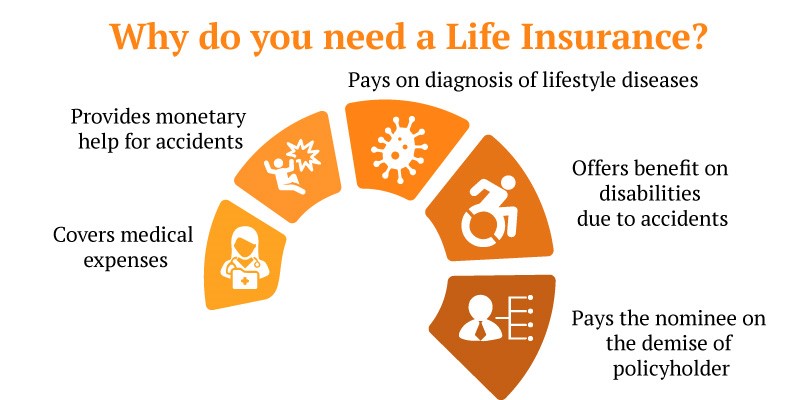

In addition to death benefits, many life insurance policies also offer living benefits.

For example, some policies have a feature called an accelerated death benefit, which allows policyholders to access a portion of the death benefit while they are still alive in the event of a terminal illness. This can help pay for medical expenses and provide financial security during a challenging time.

In addition, the living benefits provided by life insurance can help policyholders and their families manage the financial impact of a serious illness, allowing them to focus on recovery and quality of life.

3. Estate Planning

Life insurance can also be a valuable tool for estate planning. With a million-dollar life insurance policy, the death benefit can be used to help pay estate taxes and other debts, allowing the beneficiaries to keep more of the assets they inherit.

Additionally, life insurance can be used to provide an inheritance for minors, ensuring they have financial support until they reach adulthood.

Estate planning with life insurance can help ensure that your loved ones are protected and financially secure, even after you’re gone.

4. Investment Component

Some life insurance policies, such as whole life insurance, also have an investment component known as cash value.

The cash value component of a policy can grow over time and provide a source of tax-deferred savings that can be used for future expenses, such as a child’s education or retirement.

With a million-dollar life insurance policy, the cash value component can provide savings and financial security.

5. Coverage for High-Risk Individuals

Individuals who engage in high-risk activities, such as extreme sports or travel to dangerous locations, may have difficulty finding life insurance coverage.

However, a million-dollar life insurance policy can provide coverage for these individuals, ensuring that their loved ones are protected in the event of their death. “Ethos makes it smooth to apply for an online life insurance policy that fits your demands.”

Life insurance provides numerous benefits to individuals and their families. From death benefits to living and estate planning, a million-dollar life insurance policy can provide financial security and peace of mind. Consider incorporating life insurance into your financial planning strategy to ensure that your loved ones are protected in the event of your death.