PAN Aadhaar Link Status: The Central Board of Direct Taxes (CBDT) has recently introduced new regulations regarding the linking of PAN (Permanent Account Number) cards and Aadhaar cards, with a strict deadline of June 30, 2023, for compliance.

These updated directives from the Income Tax Department underscore the necessity of associating your Aadhaar with your PAN card.

Failure to link these two essential identification documents will render your PAN card inactive, which can have serious implications, particularly when engaging in transactions exceeding Rs 50,000. To ensure compliance, taxpayers are encouraged to visit the official website, www.incometax.gov.in.

The Importance of PAN-Aadhaar Linkage

For individuals who have not yet linked their PAN card with their Aadhaar card, it’s crucial to be aware of the associated late fee of Rs 1,000.

Linking your PAN and Aadhaar cards serves several important purposes, including addressing the issue of individuals holding multiple PAN cards under the same name.

Moreover, those who successfully link their PAN and Aadhaar cards will receive a consolidated summary of their tax information, aiding future tax reference. It’s vital to emphasize that unlinked PAN cards will be deactivated after the specified deadline.

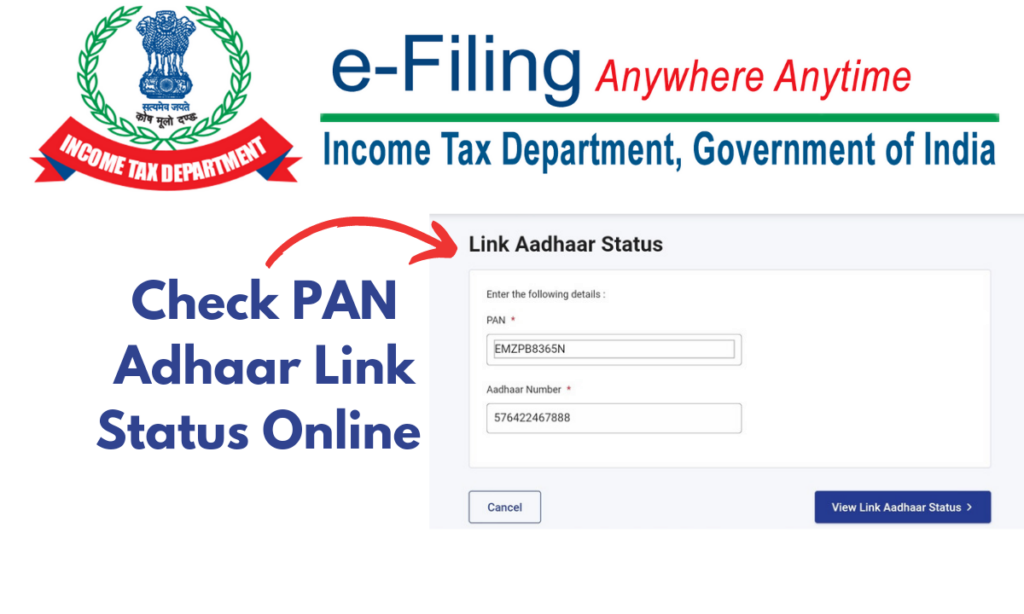

How to Check Your PAN-Aadhaar Link Status

To ascertain the status of your PAN-Aadhaar linkage, several methods are available. You can use the SMS service by providing your Aadhaar card number or furnish the name of the PAN cardholder.

Alternatively, you can visit the official website and input your PAN card number to verify the status of your Aadhaar-PAN connection.

Aadhaar PAN Link Status: www.incometax.gov.in

| Name of Card | PAN Card |

|---|---|

| Issuing Authority | Income Tax Department |

| Issuing Authority | UIDAI |

| Linking with | Aadhaar Card |

| Mode to Link | SMS, Aadhaar Card, Name |

| Last Date of Linking | June 30, 2023 |

| Official Website | www.incometax.gov.in |

| Article Category | PAN Aadhaar Link |

Checking PAN-Aadhaar Link Status by Name

If you’ve applied for linking your PAN card with your Aadhaar card, you can follow these steps to check the status:

STEP – 1: Visit the official Income Tax Department website at www.incometax.gov.in.

STEP – 2: Look for the option labeled “PAN Aadhaar Link Status By Name.”

STEP – 3: Provide both your PAN card number and Aadhaar card number as requested.

STEP – 5: After entering the necessary information, click on the “View Link Aadhaar Status” option.

STEP – 5: The system will promptly display the status on your screen.

Verifying PAN-Aadhaar Link Status in 2023

If you’ve applied for the PAN Aadhaar link and want to check your status, here’s a different set of instructions:

STEP – 1: Visit the official portal at www.incometax.gov.in.

STEP – 2: Locate the “PAN Aadhaar Link Status” option on the website.

STEP – 3: Choose to enter either your Application Number or Reference Number.

STEP – 4: After supplying the necessary details, click the “Submit” button to proceed.

STEP – 5: Your PAN Aadhaar Link Status will then be presented on the screen for your review.

Should you encounter any questions or discrepancies during this process, feel free to reach out to the relevant officials using the provided toll-free number or the grievance redressal portal.

Checking PAN Aadhaar Link Status via SMS

You can now check the status of your PAN Aadhaar link via SMS, using the mobile number associated with your PAN card. Follow these steps:

STEP – 1: Open your messaging app.

STEP – 2: Compose a new message and type “UIDPAN.”

STEP – 3: Enter your 12-digit Aadhaar card number, followed by your 10-digit PAN card number.

STEP – 4: Send the message to either 56161 or 567678.

STEP – 5: Wait for a response from the relevant department.

If your PAN card is already linked, you will receive an SMS confirming the link. Conversely, if you haven’t linked your PAN with your Aadhaar card, you will receive an SMS indicating the absence of the link.

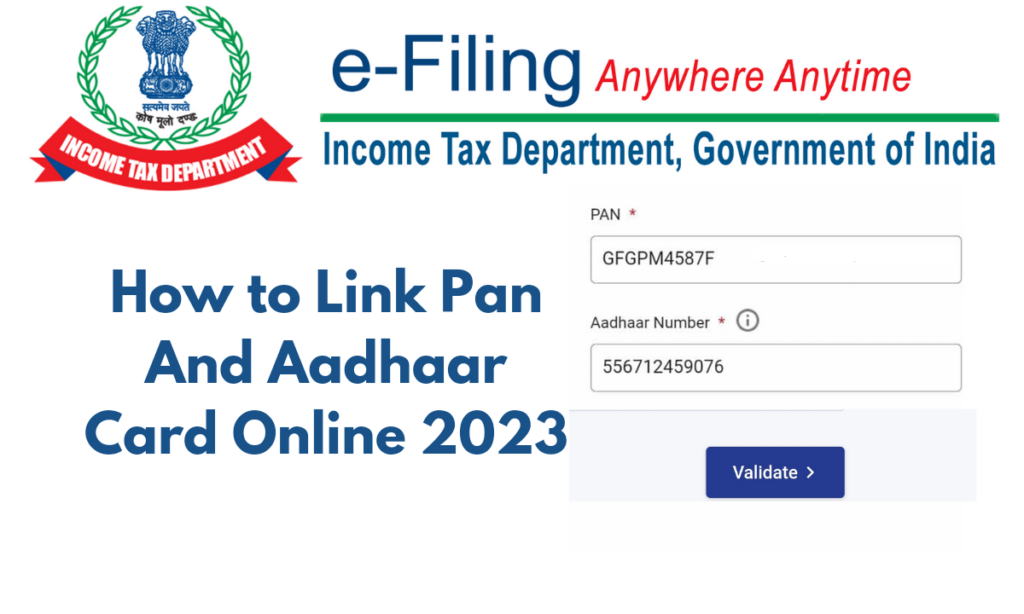

How to Link Your PAN and Aadhaar Card Online in 2023

If you wish to link your PAN card with your Aadhaar card online, follow these step-by-step instructions:

STEP – 1: Start by visiting the official website at www.incometax.gov.in.

STEP – 2: Locate and click on the “PAN Aadhaar Link” option.

STEP – 3: Provide your Aadhaar card number and verify it using the OTP (One-Time Password) you receive.

STEP – 4: Enter your PAN card number and validate it with the OTP.

STEP – 5: Complete the necessary details, including your mobile number and name.

STEP – 6: Ensure that all the information you entered is accurate, then proceed by clicking the “Aadhaar link” button.

STEP – 7: Finally, enter the 6-digit OTP sent to your registered mobile number.

STEP – 8: Your request to link your PAN and Aadhaar cards will be successfully submitted.

| Link Pan & Adhaar Card | Click Here |

| Check Pan Aadhaar Link Status | Click Here |

Some FAQs

1. Why is my PAN linked with Aadhaar?

To ensure a robust method for eliminating duplicate entries in the PAN database, it became mandatory for eligible taxpayers to include their Aadhaar number in the PAN application form and income tax return.

2. How many days does it take to link PAN with Aadhaar?

The linking of PAN and Aadhaar typically takes 6-7 days.

3. How much time does it take to link Aadhaar with PAN?

You can also link your PAN with Aadhaar through your mobile device, which is a quick process.

4. Which department provides PAN cards to applicants?

PAN cards are issued to applicants by the Income Tax Department.

5. How many digits are found on a PAN card?

A PAN card consists of a total of 10 alphanumeric digits.

6. What is the deadline for linking PAN and Aadhaar?

The final date for linking PAN and Aadhaar is June 30, 2023.

7. Which is the official website for PAN and Aadhaar Card linking?

The official website for linking PAN with Aadhaar Card is www.incometax.gov.in.

Conclusion

The CBDT’s new regulations mandate the linking of PAN and Aadhaar cards by June 30, 2023, to ensure efficient tax administration and prevent misuse of multiple PAN cards. Taxpayers are urged to comply with these directives to avoid penalties and maintain the active status of their PAN cards.

The various methods provided for checking and completing the linkage process aim to make it convenient for individuals to meet this important requirement.