Investing in real estate doesn’t have to be intimidating. Consider an intriguing opportunity with a Real Estate Investment Trust or REIT. Here you’ll find the ultimate combination of minimal capital investment and effortless dividends for maximum returns on the appreciation. Don’t miss out: Make your move into the lucrative world of real estate today.

What Is a REIT – Real Estate Investment Trust?

Investing in REITs is a great way to diversify and access real estate opportunities without the responsibilities of being a landlord. As shareholders, you can reap the financial benefits of owning fractional investments in commercial properties.

REITs are versatile investments that can offer exposure to both the equity and debt sides of commercial real estate.

On the equity side, they may invest in apartment complexes, office buildings, or retail outlets, while on the debt side, they lend money to developers as mortgage REITs help fund their projects.

Equity REITs and mortgage REITs offer various dividend options to investors, ranging from monthly payments to reinvestment at maturity. Depending on your investment strategy, there is likely an option that fits your needs.

ALSO READ: IS REAL ESTATE INVESTMENT TRUSTS A GOOD CAREER PATH?

Assets in REITs

Real Estate Investment Trusts (REITs) offer opportunities for real estate investors.

By specializing in undervalued apartment buildings and retail centers or diversifying through various income-producing assets, REIT investing can bring great returns to those who understand the unique dynamics involved.

- Apartments

- Data centers

- Hotels

- Medical centers

- Shopping malls

- Warehouses

Mortgage REITs finance commercial real estate transactions through the loan of funds.

By taking possession of collateral assets, such as property and buildings, should a borrower default on repayment – investors are safeguarded by being able to cash in distributions from sale proceeds.

How Do the REITs Work?

With REITs, investors can directly benefit from real estate investments and receive regular dividends.

Through these trusts, you must distribute a minimum of 90% of profits generated by their portfolio to shareholders in the form of income-producing rental payments.

Investors can make an attractive return from taxable income through commercial real estate without the need for a large investment or being directly attached to ownership.

Investing in REITs offers the opportunity to purchase a fraction of an asset, such as real estate or mortgages.

You join forces with other investors who contribute capital and have access to ownership opportunities that may not be available individually.

Why Should You Invest in REITs?

Even during the most turbulent times in the stock market, real estate has been a solid source of diversification for your portfolio.

By incorporating publicly traded REITs into your investing strategy, you can reduce risk and gain positive returns that you may otherwise miss with traditional stocks alone.

Investing in Real Estate Investment Trusts (REITs) can be attractive for long-term gains and consistent income.

With a strong track record of returns, these investments have the potential to provide a tangible benefit – from both capital appreciation over time or through regular dividend payments that you can reinvest as your needs change.

Taxes and Fees in Real Estate Investment Trusts

Delving into the finer details of investing is key to making informed financial decisions.

Investing in real estate investment trusts with your IRA or Roth IRA can reduce taxable income. However, funds placed with tax-exposed investments will be liable for regular taxation rates.

When investing in income-producing real estate, it’s important to consider all associated fees.

Beyond the typical annual management fee as a percentage of assets under management, there may also be charges such as early redemption and other miscellaneous costs built into investment contracts – so make sure you review any fine print thoroughly.

ALSO READ: HOW MANY JOBS ARE AVAILABLE IN REAL ESTATE INVESTMENT TRUSTS?

Types of REITs

Investing in a REIT can offer lucrative returns, but not all are created equal.

To make the most out of your investment decisions, it’s important to understand how different REITs work – from how they’re funded and managed to what kind of real estate properties they invest in.

With this knowledge, you’ll be able to select one that best suits your needs.

Public Traded equity REITs

Investing in public equity REITs is an efficient way to access the real estate market.

With shares traded on a national stock exchange, such as the NYSE, and regulated by SEC regulations, you can easily buy or sell during regular trading hours – allowing for greater liquidity than traditional investing methods.

mREITs

Mortgage REITs are a key source of investment capital for developers, builders, and those looking to purchase real estate.

Through mortgage financing, mREITs help fund the construction or acquisition of income-generating properties while earning interest from loan payments which they pass on to shareholders in the form of dividends.

PNLRs

Non-listed REITs, known as PNLRs, offer an attractive investment opportunity for savvy investors.

Despite being registered with the Securities and Exchange Commission, they are not traded on mainstream stock exchanges like NYSE – making them less liquid than their publicly tradable counterparts.

Private REITs

Private Real Estate Investment Trusts (REITs) offer a unique investment opportunity, but their lack of liquidity makes them one to consider carefully.

They are not subject to the same regulations as publicly traded REITs and are thus an option for more experienced investors looking for higher returns.

Real Estate Investment Trusts Performance

REITs have been a solid choice for investors across the last 45 years, providing attractive returns and capital appreciation compared to other stocks.

Investing in real property through REITs offers long-term benefits that many individual investors seek – not only potential rental income streams but also stability of value amidst changing market conditions.

ALSO READ: BEST PAYING JOBS IN REAL ESTATE INVESTMENT TRUSTS

How Can You Buy and Sell REITs

When investing in REITs, ensure you are aware of the timeline for required investments to avoid any early redemption fees.

Be sure to thoroughly read all conditions before purchasing to achieve your investment goals with minimal penalties.

For investors looking to get into real estate, purchasing shares through a broker is easy.

Investing in publicly traded REITs works like buying stocks – it’s that simple.

For those interested in venturing into private equity and mortgage REITs, brokers affiliated with these investments can provide direct access for purchase.

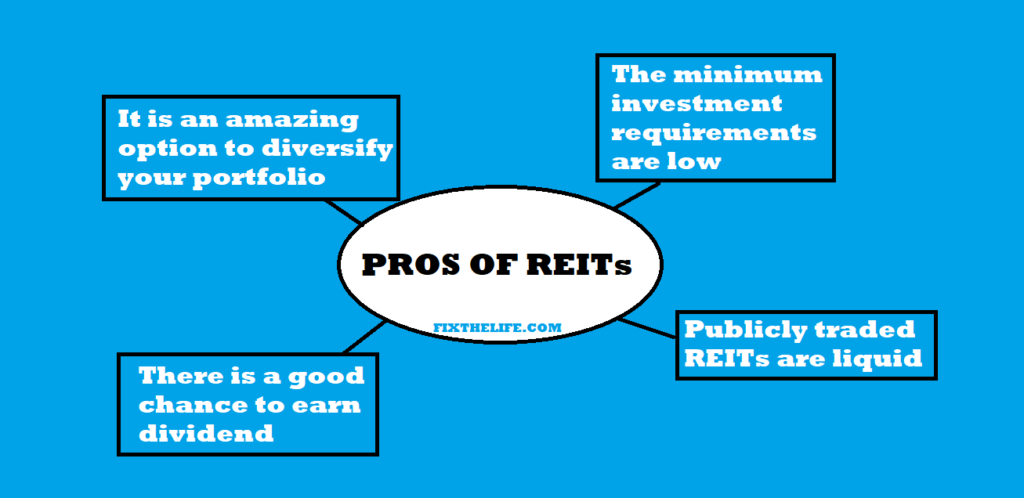

PROS of REITs

- The minimum investment requirements are low – Real estate investing has never been more accessible. Through minimal investments of just $10, anyone can break into the market and take advantage of its lucrative opportunities.

- Publicly traded REITs are liquid – With publicly-traded REITs, you can make smart investments easily liquidated when needed due to their ability to be traded anytime the market is open.

- There is a good chance to earn dividend – Investing in Real Estate Investment Trusts (REITs) can provide a lucrative source of dividend income, as many publicly traded and private REITs are known to distribute cash payments or share distributions.

- It is an amazing option to diversify your portfolio – Investing in real estate is an excellent way to diversify your portfolio and boost its growth potential. Your investment advisor can help you explore the range of options available to make educated decisions about investing in property – maximizing returns while minimizing risk along the journey.

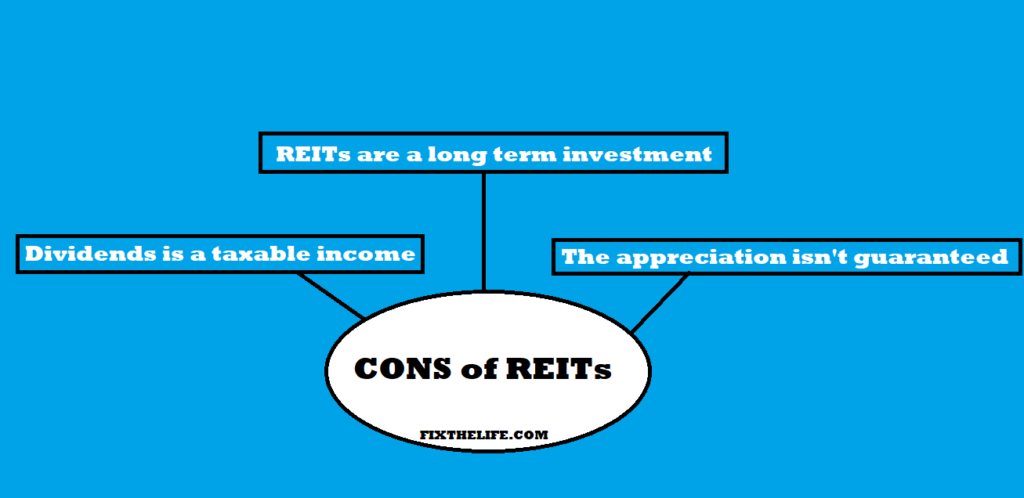

CONS of REITs

- REITs are a long term investment – Non-traded REITs provide a long-term investment opportunity with no option for early redemption—giving investors the advantage of pledging their funds to this particular type of real estate venture without fear of immediate dissipation.

- Dividends is a taxable income – To optimize your financial strategy, calculate the expected tax obligations of investing in a real estate investment trust that offers dividend payments. Speak to an experienced advisor for tailored advice and insights on making potential gains with minimal taxation.

- The appreciation isn’t guaranteed – Investing in real estate holds the potential for long-term gain, but it is important to remember that market conditions can vary drastically. The 2008 housing crisis serves as a reminder of how quickly markets can change and why it is essential always to remain prepared.

Frauds in the Real Estate Investment Trusts

As with any financial decision, it’s crucial to safeguard against potential fraud when considering investing in a REIT. Fortunately, the Securities and Exchange Commission (SEC) provides resources for recognizing red flags.

Even private non-traded REITs must register with them.

To maximize your peace of mind and security, be sure you perform comprehensive due diligence on the advisor recommending an investment opportunity and the stability of its respective REIT itself.

Begin your research by leveraging the SEC’s Edgar system, but to ensure you can make informed decisions take time to vet potential real estate companies offering REITs thoroughly.

What are the Best Performing Popular REITs

Keeping up with top-performing REITs can be challenging in ever-changing markets. Check out these currently leading options to make your portfolio shine.

- With Preferred Apartment Communities boasting an impressive one-year return of 150.90%, now is a great time to invest in their share price—currently set at $24.93.

- Blue Rock Residential Growth REIT has risen dramatically over the past twelve months, boasting a 172.57% increase in share price to now stand at an impressive $26.53 each.

- NexPoint Residential Trust’s remarkable one-year return of 96.64% has translated into an impressive share price of $90.14, showcasing the company’s strength in the competitive real estate market.

Frequently Asked Question

How Does a Company Qualify as a REIT?

To qualify as a REIT, organizations must demonstrate their commitment to high standards through an extensive qualification process. Testifying qualifications such as financial structure and dividend policies ensures potential investors can trust the investment will be secure.

- The company confidently puts its 75% assets in real estate as a long-term investment.

- The company must divide the 90% of its profits among the shareholders.

- The company must pay the taxes.

- Aim for at least 100 shareholders invested in the growth and prosperity of your company.

- With a limit of five or fewer shareholders, no single entity can control more than 50% the shares.

- To qualify, at least 75% of the gross income must be derived from rental payments, mortgage interest earnings, or capital gains.

What Is a Paper Clip REIT?

A paper clip REIT is an innovative combination of two entities – the owner and the operator.

It allows companies to manage operations more flexibly, despite their riskiness requiring extra scrutiny by SEC regulations.

This rare form of real estate investment trust goes beyond traditional methods for bringing returns on property investments.

Can I Lose Money on a REIT?

Investing in real estate has been shown to have relatively consistent rewards, but there is still the chance of losing money.

To bolster your financial security and minimize risk, diversifying across multiple investment types can help protect you from a total loss.

ALSO READ: What is High Risk Merchant Account and How to Get One?

Are REITs a Safe Choice During the Recession Times?

Investing in REITs is a great way to protect portfolios during economic downturns, as they are typically less impacted by the stock market’s volatility.

Diversifying investments with real estate asset types allows investors to enjoy greater stability and peace of mind – even when markets drop.

What Percentage of Your Portfolio Should Be In REITs?

Want to make sure your portfolio is set up for success? Make sure you talk with a financial advisor to determine the ideal allocation of REITs that best aligns with your short- and long-term goals and accommodate your personal risk tolerance.

Main Point to Remember

Looking for a way to build your real estate portfolio without breaking the bank? REIT investments are an ideal solution, providing diversification and much-needed capital appreciation. Plus, you’ll enjoy increased returns with dividends paid out regularly – giving you that extra confidence knowing that even on a small budget, commercial property is within reach. Get started by checking our website – it might be just what you need to enter this lucrative market today.

ALSO READ: How Many Jobs Are Available in Oil & Gas Production

SEE MORE: CBD Payment Processor Highriskpay.com – Everything You Need to Know