SDDFCU – Sdfcu.org is a website for San Diego County Federal Credit Union (SDCFCU), which is a financial institution that offers banking services to members in San Diego County, California. It is a type of financial organization called a credit union, a non-profit organization owned and controlled by its members. The SDDFCU credit union provides various financial products and services, such as checking and savings accounts, loans, credit cards, and investment services. Members of SDDFCU can access their accounts and perform financial transactions through the credit union’s website, mobile app, and physical branches.

Why Should You Join SDDFCU?

The San Diego County Federal Credit Union (SDDFCU) is a financial organization that serves members in San Diego County, California. Joining SDDFCU can have several advantages, including:

- The SDDFCU provides various banking services like checking and savings accounts, loans, and credit cards.

- Credit unions generally have competitive rates on financial products and services, such as lower interest rates on loans and higher interest rates on savings accounts.

- Credit unions are usually smaller and are owned and controlled by their members.

- Credit unions often prioritize serving their local communities and may provide financial education programs.

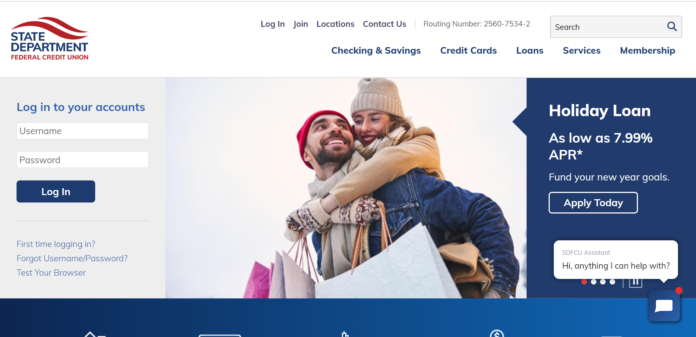

SDDFCU Holiday Personal Loan

The San Diego County Federal Credit Union (SDFCU) offers a holiday personal loan product. This type of loan is meant to assist members in covering the expenses associated with the holidays, such as gifts, travel, and more. Some potential features of the SDFCU holiday personal loan are:

- Loan amounts: The loan amount may vary depending on the borrower’s creditworthiness and financial situation.

- Repayment terms: The repayment terms, including the duration of the loan and the monthly payment amount, may vary based on the loan amount and the borrower’s creditworthiness.

- Interest rates: The interest rate on a loan may vary depending on the borrower’s creditworthiness and market conditions. Credit unions generally offer competitive interest rates on loans compared to traditional banks.

- Fees: There may be fees associated with the loan, such as an origination fee or a late payment fee. It’s important to carefully review the loan terms and any fees before accepting the loan.

It is a good practice to thoroughly review the terms and conditions of any loan before accepting it to make sure it aligns with your financial needs and objectives. Contact the credit union directly for further information if you have any queries regarding the SDDFCU holiday personal loan.

How Can You Join SDFCU?

To become a member of the San Diego County Federal Credit Union (SDFCU), you will need to follow these steps:

Check your eligibility: SDFCU membership is open to individuals who live, work, worship, or attend school in San Diego County, California, as well as immediate family members of current SDDFCU members.

- Go to the SDFCU website (sdfcu.org) and click on the “Join Now” button in the top right corner of the page.

- Follow the on-screen instructions to begin the membership process, which may include filling out an online application and providing proof of eligibility, such as a driver’s license or other identification.

- Review and accept the terms and conditions for SDDFCU membership.

- Once your application is approved, you must open a savings account with a minimum deposit of $25 to complete the membership process.

ALSO CHECK: Everything You Need to Know Before Making Any Financial Decision.

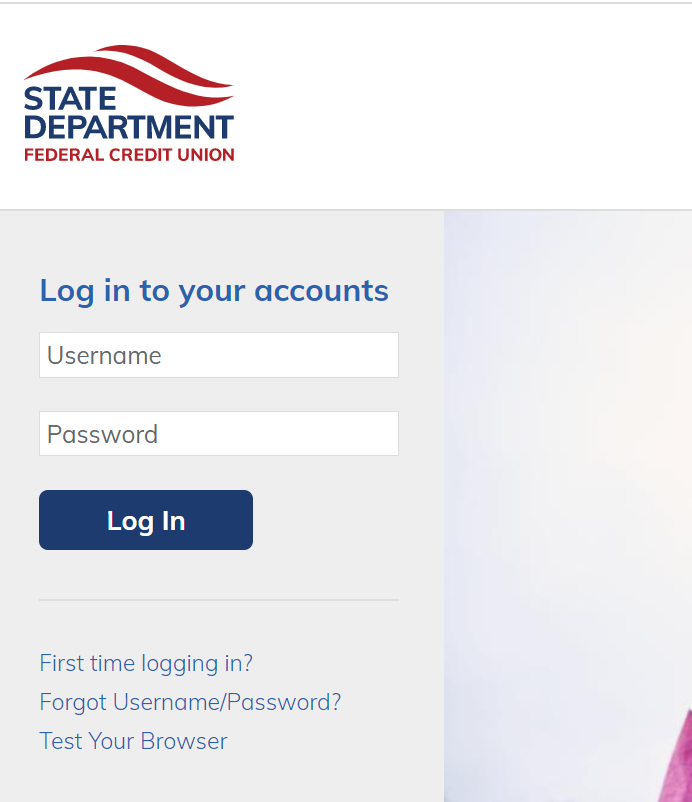

How to Do a Successful SDDFCU Login?

San Diego County Federal Credit Union (SDFCU) online banking account login process, follow these steps:

- Visit the SDFCU website (sdfcu.org) and tap on the “Log In” button in the top right corner.

- Fill in your username and password in the designated fields on the login page.

- Tap the “Log In” button to access your online banking account.

If you have lost or forgotten the credentials, then follow these steps:

- Choose “Forgot your username/password? to reset or recover the username or password.

If you need more help, then contact SDDFCU customer service.

SDDFCU Customer Service

Conclusion

In summary, San Diego County Federal Credit Union (SDFCU) offers superior customer service compared to many large banks and competitive rates. This makes it a viable option for those without plans to switch banks. However, it should be noted that the SDDFCU may have a different level of convenience than online banking. For some residents, bank branches may still be preferred due to their accessibility for quick customer service.