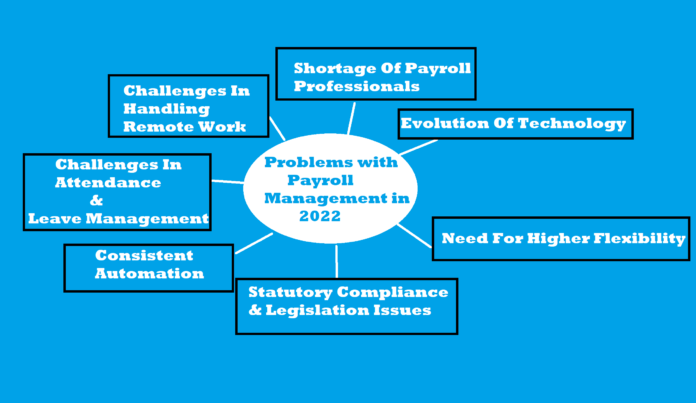

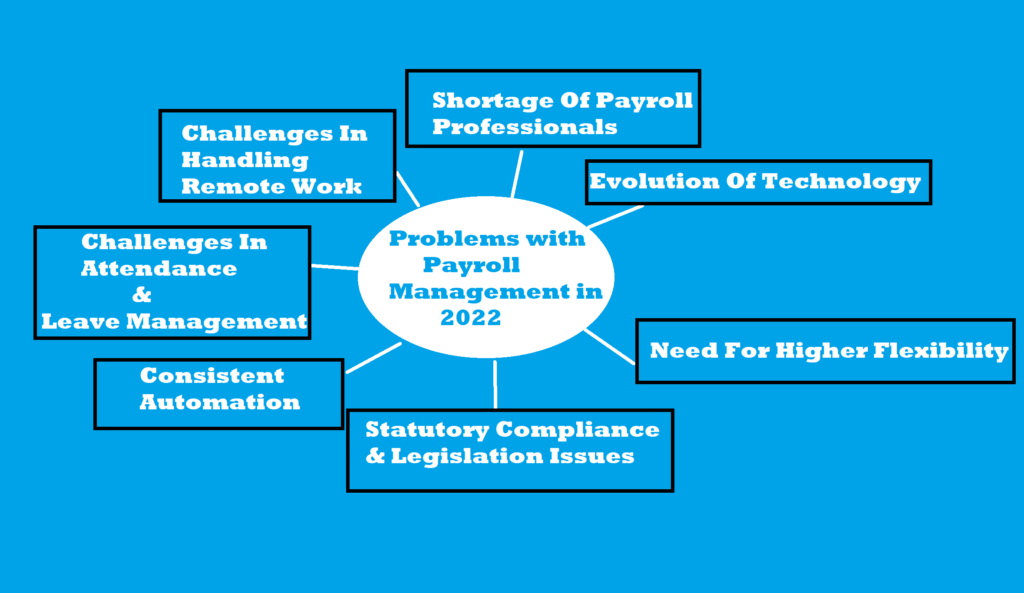

Payroll is one of those processes that most people take for granted. After all, it’s just a bunch of numbers that get transferred from one account to another. Unfortunately, this is only sometimes the case. In fact, payroll can be quite complex and troublesome if done incorrectly. If you’re having trouble with your payroll system, don’t worry; we have compiled a list of the top problems with payroll management in 2022 so that you can fix them before they cause any more headaches. Read on to learn more.

What are The Problems with Payroll Management in 2022

Evolution Of Technology

In 2022, payroll management will still be a problem for many businesses. The main reason for this is that technology has evolved at such a rapid pace that many traditional methods of payroll management no longer work well.

This means businesses will need to find new methods of Payroll Management to keep up with the times.

One of the main problems with traditional methods of payroll management is that they are often time-consuming and difficult to use.

In addition, they can be expensive to implement and maintain. As a result, many businesses are looking for alternative methods of Payroll Management.

One alternative method of Payroll Management is electronic pay stubs. This approach is easy to use and relatively cheap to implement.

In addition, it can be used by businesses of all sizes. Another benefit of an online pay stub generator is that it can help to improve employee morale. One downside of electronic pay stubs is that they can be inaccurate.

This is because they rely on the employer’s financial data accuracy. If this data is inaccurate, the pay stubs will also be inaccurate.

Overall, technology will continue to play an important role in Payroll Management in 2022. This means that businesses will need to find new and innovative ways of doing things if they want to stay competitive.

ALSO READ: How Many Jobs are Available in Consumer Non-durables

Statutory Compliance & Legislation Issues

Businesses should be aware of many statutory compliance and legislation issues when managing their payroll. Issues such as complying with minimum wage, overtime regulations, PIP rules, and more can often lead to fines and complications for companies.

In addition, ensuring that employees are properly registered with the government can help keep them safe and help protect company data.

To avoid potential headaches, it is important to particularly have a sound understanding of the applicable laws and regulations governing payroll.

This overview will discuss some of the most common statutory compliance issues and how they can impact your business.

Need For Higher Flexibility

As businesses continue to grow and evolve, the need for higher flexibility in payroll management will become even more pronounced in 2022.

With more employees working remotely and across different time zones, traditional payroll systems are not equipped to handle the complexities of modern work. This could lead to increased errors and delays in payments, which can significantly impact employee morale and productivity.

Here is why you need higher flexibility in payroll.

1. Payroll administration can be very time-consuming and complex, which is why businesses are looking for more payroll flexibility.

2. Many businesses need to outsource some of the labor-intensive aspects of their payroll processing to keep up with the demands of the modern workplace.

3. In order to particularly stay competitive, businesses need to be able to quickly and easily adapt their payroll processes as needed to keep up with changes in the market.

ALSO READ: Is Oil & Gas Production A Good Career Path?

Shortage Of Payroll Professionals

As the economy particularly continues to rebound from the pandemic, businesses are struggling to find enough payroll professionals to handle their increased workload.

The shortage of qualified payroll professionals is expected to continue into 2022, making it difficult for particular businesses to keep up with demand.

This could lead to errors and delays in processing payroll, which can negatively impact employee morale and productivity.

PRO TIP: Keep payroll records for up to three years.

Challenges In Attendance & Leave Management

In order to keep your payroll process running smoothly, it is important to have a clear understanding of the particular challenges that can arise.

One of the most common issues when managing employee attendance and leave is miscommunication. When employees need help understanding their roles or what is required, they are less likely to be prompt and reliable.

Additionally, if an employee is absent or takes leave without properly notifying their supervisor, this can create additional administrative burdens for you.

To avoid these complications, it is particularly necessary to have a system that clearly defines each employee’s responsibilities and outlines the steps necessary for requesting leave.

Additionally, it is essential to communicate with particular employees regularly about their progress in completing their duties and ensuring they know when their leave will be returned.

By properly managing attendance and leave records, you can help ensure that your payroll process runs smoothly and that you can effectively manage your workforce.

ALSO READ: How Many Jobs are Available in Consumer Services : Complete Guide

Challenges In Handling Remote Work

Remote work is becoming increasingly popular, but there are still many challenges to overcome regarding payroll management.

One of the most difficult issues is ensuring that employees receive the correct paychecks even when working from a different location. Additionally, ensuring all taxes and deductions are considered can be a challenge. Payroll taxes withheld by employers make up almost 72% of all revenue.

Managing expenses can also be challenging when employees work from home, as they may need access to regular office supplies or facilities. Finally, coordinating updates with employees’ managers can be difficult when they are located in different places.

Consistent Automation

A payroll system should be automated to ensure a consistent flow of information between employees, managers, and the company.

However, many businesses need help with creating an effective payroll solution due to the numerous problems that can arise.

Here are some of the top issues with payroll management:

1. Inaccurate Payroll Data:

A major issue with a failed payroll system is inaccurate data. This can lead to incorrect payouts, lost deductions, and even tax fraud. To avoid this complication, ensure that all data input into your system is accurate and up-to-date.

2. Unclear Authorization Procedures:

Another common problem with a payroll system needs is clearer authorization procedures. This can lead to employees receiving improper payments or not receiving them. Make sure that all rules and guidelines are clear and easily understood by everyone involved in the process.

3. Failed Automated Processes:

One of the biggest dangers of an automated payroll system is that it can fail in various ways. This can disrupt the regular flow of information between employees, managers, and the company, resulting in chaos and confusion. To avoid this complication, ensure all automated processes are functioning properly during development and once they go live on the network.

4. Inability to Add Employees:

Another common problem with a payroll system is its inability to add new employees quickly and easily. This can cause payout delays and create additional headaches for managers trying to manage their workforce.

ALSO READ: IS CONSUMER NON-DURABLES A GOOD CAREER PATH IN 2023

Final Thoughts

As we move into the new year, it’s important to be aware of the potential problems that can arise with payroll management. These problems can include incorrect calculations, late payments, and administrative errors. By being aware of these issues and taking steps to prevent them, you can help ensure a successful year for your business.

ALSO READ: THE BEST PAYING JOBS IN MISCELLANEOUS IN 2023 🧑💼