What is a grantor of a trust? The process of setting up a trust can be complex and may involve many decisions, including determining the roles and responsibilities of those involved and understanding the logistics involved. However, it all begins with the Grantor, the individual who establishes the trust. In this article, we have included the Grantor & Grantee definitions in simple terms, so keep reading the article.

Grantor & Grantee Definitions

Grantor

The Grantor is the person responsible for transferring or placing a lien on the property, as indicated by a Lis Pendens, Judgments, Writ of Attachment, or Claims of Separate or Community Property recorded on the document. This is typically the person who signed the document, such as the seller on a deed or the borrower on a mortgage.

In Plain Words –

The Grantor is the person who is transferring or placing a legal claim on a property. This can be seen on documents like deeds or mortgages and is usually the person who signed the document. For example, the Grantor would be the seller of a property on a deed or the borrower on a mortgage.

Grantee

The Grantee is the person receiving or taking ownership of a property or the person holding a lien on it. They are often the property buyer or the person with a legal claim on it.

On legal documents, the Grantee is usually listed at the top when “vs.” appears, and the Grantor is listed at the bottom. In court documents, the Grantee is often referred to as the Petitioner, and the Grantor is referred to as the Respondent.

In Plain Words –

The Grantee is the person who is getting or becoming the new property owner or has a legal right to it, like a lien holder. They are usually the person buying a property or has a legal claim on it.

On legal papers, the Grantee is at the top when “vs.” is written, and Grantor is written at the bottom.

In court papers, the Grantee is the person who is asking for something and is called the Petitioner, and the Grantor is the person who is responding and is called the Respondent.

What is a Grantor?

A grantor is the person who sets up and gives money or property to a trust. A trust is a legal plan used to give out property and money after someone dies, and it can also be used to take care of your things while you’re still alive. One good thing about trusts is that the things in them don’t have to go through probate, which is a legal process where a court makes sure your stuff goes to the right people.

When making a trust, the Grantor usually chooses themselves, someone else, or an organization to manage the trust and the things in it. This person or organization is called the “trustee.”

A grantor may also be known as a “trustor” or “settlor.”

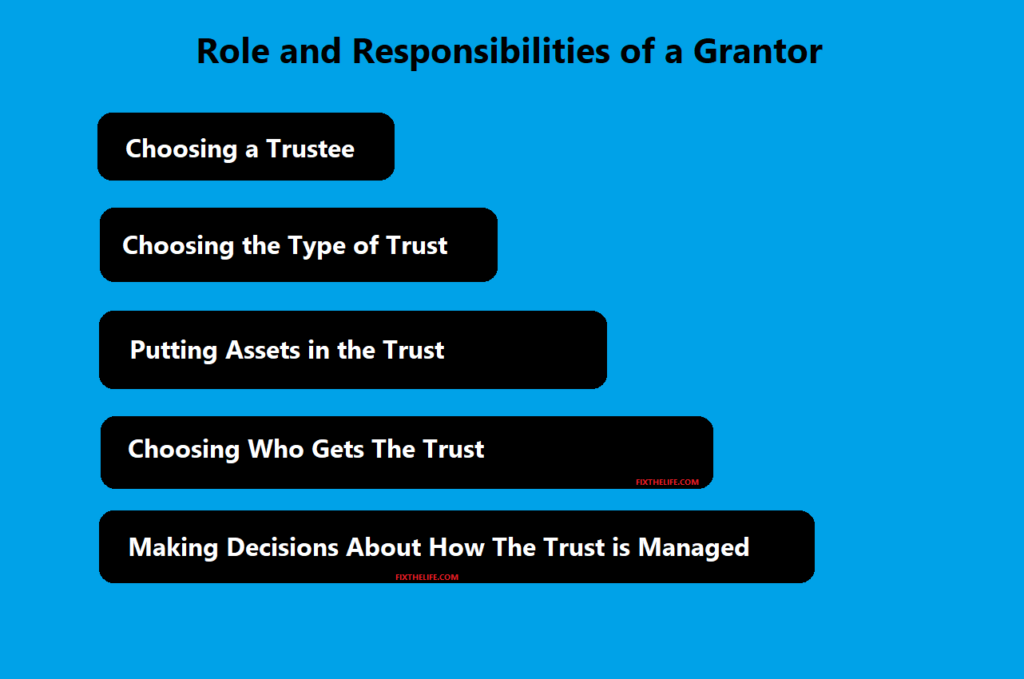

Role and Responsibilities of a Grantor

As a grantor, you make all the important choices about how your trust is set up and managed. Your jobs include:

Choosing the type of trust: There are many types of trust to choose from, each with different benefits. Before starting a trust, you must decide which is best for you.

Putting assets in the trust: As the Grantor, it’s your job to put things, like property or money, in the trust. You do this by making the trust the legal owner of your property. Depending on what you’re putting in the trust, you might need to fill out forms, change the title, or make a new deed. You can put different types of things in trust, like personal property, real estate, stocks, a life insurance policy, cryptocurrency, or other assets.

Choosing a trustee: The Grantor has to pick someone or an organization to manage the trust. This person is called the trustee. If you want, you can be the trustee yourself, but you’ll need to choose someone else to take over if you can’t do it anymore or when you pass away.

Choosing who gets the trust: When you’re making a trust for estate planning, you need to decide who gets the things in the trust while you’re alive and who gets them after you die. These people or organizations are called beneficiaries. They can be your family, friends, or even a charity you like.

Making decisions about how the trust is managed: You get to decide how the trust is run; this can include rules about when or how the beneficiaries get the things in the trust (like waiting until a certain age or after certain events, like finishing college). The trustee will ensure the trust is run the way you want it to be.

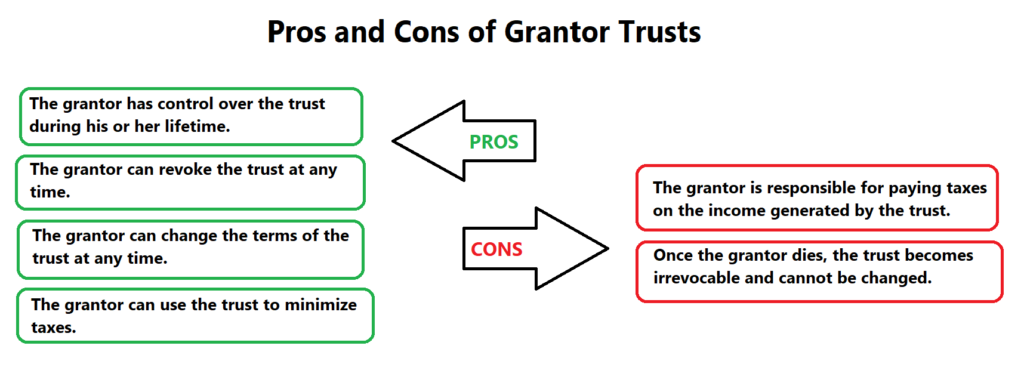

Grantor Trusts – PROS AND CONS

Grantor vs. Grantee : What is the difference?

A grantor is a person who starts and gives things to a trust, while a grantee is a person who gets the benefit from the trust. The Grantor makes the trust and puts things in it while the Grantee gets to use or receive those things. They are two different people with different roles in a trust.

Grantor vs. Trustee: What is the difference?

When someone creates a trust, they have to pick a trustee. A trustee is a person or organization that is in charge of managing the trust.

The Grantor tells the trustee what they are allowed and not allowed to do for the trust, and it’s written in the trust documents. These rules are usually made to help the beneficiaries.

Sometimes, the person who made the trust wants to be the trustee themselves and take care of it while they’re still alive and able to. If that’s the case, they need to pick someone else to be the trustee when they die or can’t do it anymore.

Grantor vs. Settlor: What is the difference?

When people make real estate plans, “grantor” and “settlor” are the same thing. The settlor is the person who creates trust. This includes putting things in the trust and making important choices, like who will take care of it and who will benefit from it.

This person is also sometimes called a “trustor.”

Is it Necessary to create Trust?

A trust can be a good way to plan for real estate. There are many benefits to having a trust, like a revocable living trust. This kind of trust lets you keep control of your things while you’re alive, and it can also change and help your things avoid probate after you die.

If you have a lot of things or your plan is complicated, talking to a lawyer who knows about estate planning can help you decide if a trust is right for you. They can help you determine which kind of trust is best and guide you through setting it up.

You can also make trust on your own, especially if you don’t have many things and your plan is simple.

I hope now you have gathered a significant knowledge on What is a grantor of a trust and Grantor vs. Grantee.