Today we will take a closer look on high risk merchant account highriskpay.com, and other high risk payment processors.

Digital payments are quickly becoming the clear choice for businesses looking to save on payment processing costs. With an overwhelming 81% of consumers now turning away from cash in favor of digital alternatives, there is no doubt that this trend will keep growing exponentially. Only 19% preferred cash payments over digital ones.

Payment services providers serve a variety of business types, with some being more reserved around high-risk industries that require extra monitoring. To ensure the success and security of these transactions, you must take greater caution to prevent fraud or other related issues from arising.

Finding a payment processor that fits your needs can be challenging, especially if you’re in the “high-risk” category. But what makes businesses high-risk, and how can they ensure they find the perfect partner? This article will arm you with vital information to make sure you select an ideal processing partner for your business requirements.

Keep reading to know more on high risk merchant account highriskpay.com and other payment processors.

What Is a High Risk Merchant Account?

Running a high-risk business can be challenging, but it’s possible to accept debit and credit card payments by obtaining a merchant account designed with the specific needs of these businesses in mind.

High-risk accounts cover many activities with an elevated risk for chargebacks or fraud – allowing businesses within certain industries to thrive without worrying about payment processing issues.

The payments industry faces the challenge of maximum risk due to a lack of unified standards across banks and processors.

Without an overarching framework, organizations must adhere to individual parameters defined by each partner for financial transaction security.

Payment solution providers have varied approaches to risk management, from openly stating excluded industries upfront to assessing each business on individual criteria.

It’s important for businesses seeking a payment provider to understand their chosen processor’s approach and internal standards to mitigate potential risks associated with accepting payments.

What Are The Factors That Determine If a Merchant Is High Risk?

Businesses in certain riskier industries may promptly be identified as high-risk. These include, but are not limited to, gambling, pharmaceuticals, and adult entertainment.

- E-cigarettes, CBD, and vape

- Tasers and Stun guns

- Credit Repair

- MLM (Multi-level Marketing)

- Adult services/products

- Pawn shops

- Supplements & nutraceuticals

- Tech support Services

- SEO -Search Engine Optimization services

Beyond traditional metrics, various factors can contribute to categorizing any given business as “high-risk.”

- As a new business, you could be labeled as “high-risk” by some payment processors. This means that accessing traditional processing solutions for secure payments may take a lot of work – an important factor to consider when setting up a shop.

- Unfavorable credit histories and scores can impact a processor’s risk perception; being on the match list could further increase your vulnerability.

- Businesses with potentially contentious product lines or operating within complex legal parameters must be extra aware of the implications. Being proactive and conscious can help ensure compliance while protecting both their bottom line, as well as their reputation.

- International sales may be a double-edged sword for businesses, with dynamic economic conditions abroad elevating risk scores.

- Industries operating under heavy oversight by governments are subject to high-risk regulations. To stay competitive, businesses must remain vigilant in their compliance efforts and adaptive to the ever-changing legislative landscape.

Difference Between High Risk Accounts and Low Risk Accounts for Payment Processors?

High-risk businesses can experience difficulty when trying to secure payment processing. Luckily, some processors may be willing to work with them by introducing measures that offset the inherent risk.

Payment processing companies have access to strategies that can considerably reduce risk, setting them apart from high-risk and regular merchant accounts.

Exploring these mitigation methods is essential for any savvy business aiming to protect its bottom line and reputation.

Application Process Takes Longer Time

A high risk merchant account requires a careful analysis of your risk profile.

This is why payment processing companies will often go the extra mile to review details such as business and personal credit histories to ensure that all necessary precautions are taken.

It’s important for businesses seeking this type of service provider to know they may need more detailed information than usual to apply successfully.

The Payment Processing Fees is on Higher Side

For small businesses, payment processing fees are typically calculated as a 0.3% markup on top of the interchange rate.

However, this can quickly increase to 1.5% when operating in high-risk industries or using certain merchant accounts, resulting in an additional expense for companies that require services associated with higher-risk operations and transactions.

Cash Reserve is Required

Payment solution providers can work to safeguard businesses by providing a financial hedge. Specifically, they manage reserve thresholds through intricate strategies that ensure safety and security.

- Rolling reserve. With a high-risk payment processor, your business can benefit from reserving up to 10% of each transaction for later. This six-month rolling agreement allows you to receive the balance at the end of every cycle – ensuring that revenue is always on time.

- Capped reserve. To ensure a consistent level of funding, the processor carefully manages each transaction to build up reserves. Once this set limit is reached, individual contributions will cease, but previous funds will remain secure in reserve.

- Upfront reserve. Merchant payments are safeguarded by high-risk processors who take a set fee upfront to protect against fraudulent transactions. To ensure security, the processor may temporarily pause all activity until the amount is paid in full.

The Chargeback Fees is On Higher Side

Businesses that typically experience high chargeback ratios, such as clothing brands, may feel the pressure of costly processor fees. The rate of these charges can range between $20 and $100 per refund – a significant expense to offset any potential risks due to excessive returns.

Credit Card Processing Limitations

As your business grows, so too may the risk to credit card processors. Exceeding preset transaction volumes could result in having processing capabilities shut off – a safeguard against potential exposure due to increased sales activity.

Additional Conditions

Many businesses process payments differently- depending on their risk level. For merchants selling age-sensitive products, payment processors may require additional steps to ensure they are not inadvertently serving underage consumers.

Only after all criteria have been met can a merchant’s processing account be approved, and transactions commence.

What to Do If You’re a High-risk Business and Need a Payment Processor

Finding the right payment processor as a high-risk merchant can be daunting, but there are measures you can take to maximize your chances of success. Keep these tips in mind when searching for an appropriate solution.

- Exploring healthy cash levels for your business is essential to creating a picture of financial stability, thus reducing any perceived risk from processors. Maintaining such balance presents an opportunity to improve the success rate when it comes to times for growth and expansion.

- Reducing chargebacks is a must-do for any business. To ensure your company continues to succeed, you must pinpoint the root causes of these issues and take steps toward solving them.

- In industries such as eCommerce, this may be caused by discrepancies between product descriptions and actual products or lengthy delivery times, both of which can contribute to customer dissatisfaction. By identifying patterns in data analysis, businesses have taken strides forward when reducing their chargeback rates – all while creating better customer experiences.

- Being candid about your business and finances is critical for any merchant desiring a successful application process. Refusing to disclose all relevant information could damage potential growth and success while reducing credibility. Cross-examination of your materials may occur during the review stage; therefore, it’s wise to remain open and honest with processors right from the start.

- Being prepared is key when it comes to processing documents. Make sure you have the necessary bank statements and tax returns ready – typically, six months of banking records and a few years worth of taxes should do the trick. It’s also important to be aware of any specific requirements as demanded by your processor; always double-check before getting started.

- When applying for a high-risk processing solution, it’s important to consider your payment processor’s advice – not just in terms of meeting the needs of your business but also being aware that greater risks often require more flexibility. Speak with them directly and explore ways to lower any associated risk factors.

How Can You Find a Best High risk Merchant Account Services Provider

You may require tailored solutions for your specialized needs as a high-risk business operator.

Arranging private meetings with representatives from merchant account providers could be the key to uncovering personalized pricing information relevant to your organization and its unique requirements.

Get the most out of your merchant account by exploring specialized payment processors for high-risk industries.

From Durango Merchant Services to Soar Payments, there are plenty of options that could be a valuable addition to your business strategy.

You must make many choices, but which one truly rises above the rest?

You must do your due diligence and consider all of their unique characteristics. Ask detailed questions about each option until you can make an informed decision.

- What expertise do they bring to the table, specifically in servicing businesses in your industry?

- How long does it take to process payments? We strive for swift financial transaction completion and reliable customer satisfaction.

- Does this entity have a mandatory amount of funds to set aside for future operations?

- Our payment solutions offer various options beyond traditional cards, such as eChecks and ACH payments.

- Planning for the future? Will you be liable for an early termination fee if you switch providers down the line?

- Our provider offers modernized payment solutions ranging from POS machines to intuitive virtual terminals. Enjoy the latest in checkout technology, streamlining your business’s payment process.

- Discover the level of customer support they provide – from robustness to accessibility. Find out if their team is ready to help you with your every need.

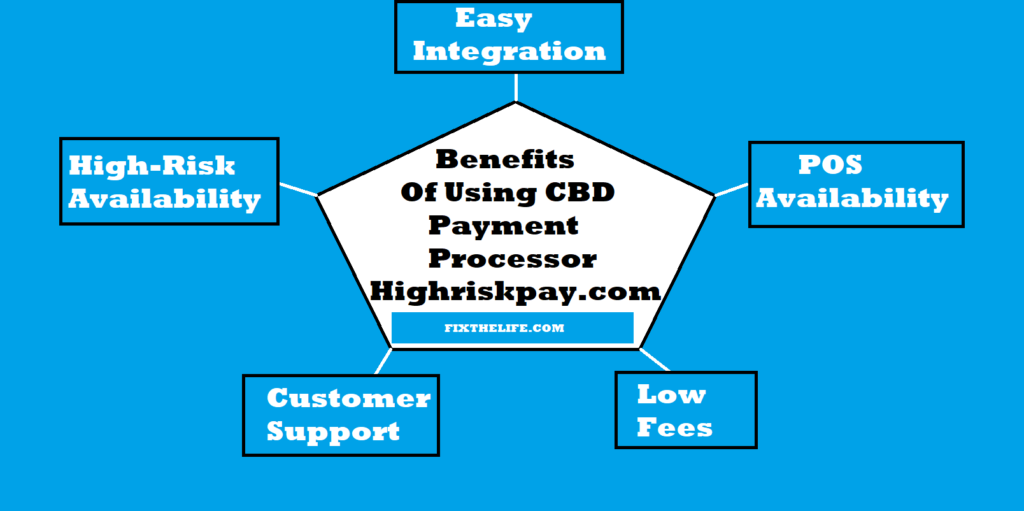

Does HighRiskPay.com Supports High Risk Businesses?

High Risk Pay has skyrocketed to the top of the credit card industry in only twenty years. They specialize in an innovative combination, offering high-risk and offshore merchant accounts for their clients’ needs.

For businesses looking to enter the CBD marketplace, getting a merchant account may be one of the biggest challenges they face.

Profiting from cannabidiol is no longer a far-fetched dream. With U.S. sales expected to hit $1.8 billion in the coming years, setting up an online CBD store could be your ticket to success.

However, turning this promising opportunity into tangible growth requires more than just running numbers. It takes savvy business know-how and strategy for maximum profit potential.

Navigating the complexities of setting up a CBD merchant account and securing reliable payment processing technology can be daunting when launching an online business. Doing your research is vital to ensure success – as taking payments will allow you to start accepting orders.

Struggling to set up a CBD payment processing system? Don’t worry; you’re not alone in this. Managing e-commerce accounts can be intimidating, but it’s essential for making your business successful.

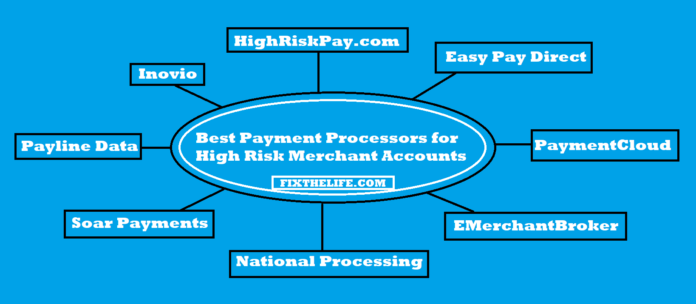

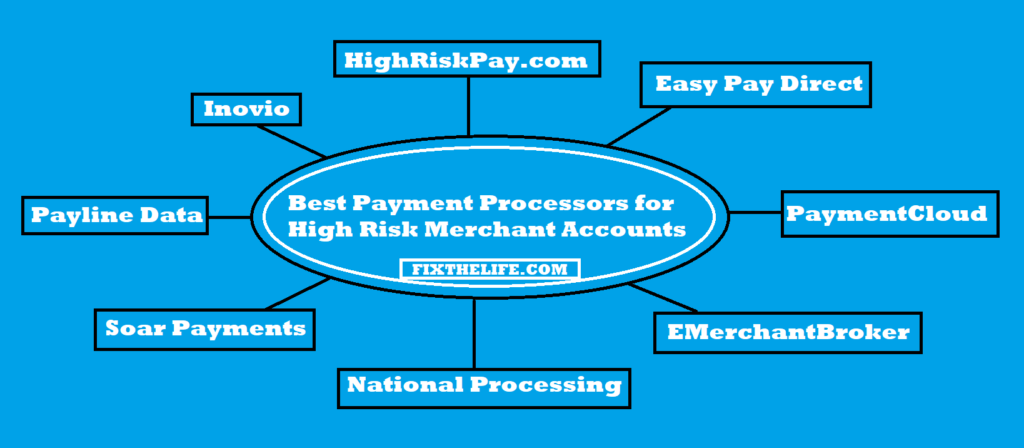

To find the High Risk Merchant Account Providers like HighRiskPay.com check out the list below:

Best Payment Processors for High Risk Merchant Accounts

PaymentCloud

Price: It is Quote based, and the monthly fees start from $10.

Transaction type: In-person, recurring and online payments.

Point-of-sale: 3rd Party.

Integrations: Customer relationship management is supported by: Intacct and Oracle. The shopping carts include OpenCart, WooCommerce, Shopify, Magento, and WordPress. Zendesk and Slack support virtual software systems.

Advantages

- It accepts almost every type of transaction.

- Famous integrations.

Dis-Advantages:

- The pricing is based on Quote.

- The point of sale is only third-party.

Why we recommend this: PaymentCloud offers a competitive edge in the market—no lengthy contracts, swift deposits, and specialized solutions for high-risk merchants. It’s no wonder small businesses turn to them as their go-to provider.

Easy Pay Direct

Price: The price is based on Quote.

Transaction types: In-person, recurring and online payments.

Point of Sale: 3rd Party.

Integrations: It offers 250+ shopping cart integrations, such as Weebly, Wix, Ecwid, OpenCart, WordPress, Shopify, and Magento,

Advantages:

- It accepts almost every type of transaction

- Popular integrations for carts.

Dis-Advantages:

- The pricing is based on Quote.

- The point of sale is only third-party.

Why we recommend this: Easy Pay Direct offers diverse integrative options, enabling businesses to accept payments without changing their current shopping cart system. You can find what works best for your company with hundreds of carts supported.

EMerchantBroker

Pricing: The price is based on Quote.

Transaction types: In-person, recurring and online payments.

Point of Sale: 3rd Party.

Integrations: Offers shopping carts such as WooCommerce, Wix, BigCommerce, and Shopify.

Advantages:

- It accepts almost every type of transaction

- Popular integrations for carts.

Dis-Advantages:

- The pricing is based on Quote.

- The point of sale is only third-party.

We recommend this: eMerchantBroker gives high-risk businesses an edge with lightning-fast approvals. In as little as 24 to 48 hours, you can accept payments—saving you valuable time and energy compared to other processors that take days before giving the green light.

High Risk Merchant Account HighRiskPay.com

Price: 2.95% plus 25 cents and varies with the use of cards and transaction type. The monthly fee starts from $9.95.

Transaction types: In-person, recurring and online payments.

Point of Sale: No One

Integrations: Shopping carts have Shopify.

Advantages:

- Transparent price.

- It accepts almost every type of transaction

- Best for adult theme businesses.

Dis-Advantages:

- A monthly fee is required.

- POS not included in a service

- Limited shopping carts.

Why we Recommend this: HighRiskPay.com provides tailored rates for businesses of all shapes and sizes, no matter the credit score or industry sector- including adult-themed products. Experienced merchants in this niche receive just a quarter more per transaction than other high-risk business services rate – an extra 25 cents to keep your payments secure without sacrificing affordability.

RELATED: CBD Payment Processor Highriskpay.com – Everything You Need to Know

Inovio

Pricing: The price is based on Quote.

Transaction types: Recurring and online payments.

Point of Sale: Inovio virtual POS.

Integrations: Includes CartConnect, Infusionsoft helps with marketing and sales, and Nats supports for advertising.

Advantages:

- Proprietary POS is available.

Dis-Advantages:

- The pricing is based on Quote.

- Inn-person payment is not available.

- Limited integrations.

We recommend that this Inovio revolutionize the payments industry with its state-of-the-art payment processing solutions. Enjoy secure and user-friendly checkout experiences and customizable gateway APIs so you can easily manage multiple locations. Forget about juggling between contacts – Inovio offers a comprehensive suite of services to care for your payment needs.

National Processing

Price:

- For Restaurant: interchange + 0.14% & seven cents on every transaction.

- For Retail: interchange + 0.18% & ten cents on every transaction.

- For E-commerce: interchange + 0.29% & 15 cents on every transaction.

- Subscription: interchange + nine cents on every transaction.

- Subscription Plus: interchange + five cents on every transaction.

Transaction types: In-person, recurring and online payments.

Point of Sale: 3rd Party.

Integrations: OpenCart, WordPress, Shopify, QuickBooks, WooCommerce, BigCommerce, Ecwid, and Zendesk

Advantages:

- Transparency in prices.

- Accepts most transaction types.

- Popular integrations.

Dis-Advantages:

- Requirement of monthly fees.

- The point of sale is only third-party.

Why we recommend this: National Processing offers customized plans for businesses that can help you reduce your processing fees. You can also offer cash discounts or ACH transfers, allowing customers to enjoy lower prices on card payments and incentivizing them to select the more cost-effective option of paying with cash.

Payline Data

Price:

- Interchange + 0.4% & 10 cents for in-person transactions and a monthly fee of $10.

- Interchange + 0.75% & 20 cents for online transactions and a monthly fee of $20.

Transaction Types: In-person, recurring and online payments.

Point of Sale: Third-party.

Integrations: QuickBooks and some other trusted shopping cart apps.

Advantages:

- Transparency in price.

- Accepts every transaction type.

- Popular integrations.

Cons:

- Negative reviews

- POS is available only via a third party.

Why we recommend this: With its industry-leading Interchange Plus pricing and incredibly low per-transaction rate, Payline Data ensures you get the best bang for your buck. Whether it’s Visa or American Express cards accepted by your business, chances are that our services can save money compared to other available options.

Soar Payments

Price: Based on Quote.

Transaction Types: In-person, recurring and online payments.

Point of Sale: 3rd Party.

Integrations: Including QuickBooks or Zoho for accounting, Shopify, and BigCommerce through WooCommerce and Magento if you need shopping carts – all rounded off with Click Funnels or Infusionsoft for marketing.

Advantages:

- Accepts all transaction types.

- Popular integrations.

Cons:

- The price is based on Quote.

- Recurring billing services are only offered for some integrations.

- Restrictions on recurring billing approval.

Why we recommend this: Soar Payments offers an incredibly impressive range of services, with over 50 industries listed. Businesses in nontraditional sectors or struggling to locate the right processor will undoubtedly benefit from taking a closer look at Soar’s diverse offerings.

Final Words

Companies are constantly in flux when it comes to gauging which businesses have an increased risk profile. Changing and often opaque criteria determine what merchant processors deem as ‘high-risk,’ so merchants must be vigilant for any shifts that may cause them to lose their payment partner without warning.

Ensure your business success with highriskpay.com and safeguard yourself from any unexpected mishaps. Invest in a processor that guarantees reliability now to focus on the future.

Frequently Asked Questions

What is a high risk merchant account?

Payment processors must be extra vigilant with “high-risk” merchants.

This could mean they’ve noticed a greater chance of fraudulent activity, chargebacks, returns, and extended waiting periods that can cause complications – all of which require additional processing fees to protect against risk factors.

What is a low-risk merchant account?

For merchants with low volumes of transactions and average sales under $500, the benefit is a reduced processing fee.

Such businesses are in industries that see minimal chargebacks, fraud, or returns due to their lower risk factors, making them an attractive option for payment processors.

What businesses are considered high-risk?

High-risk businesses can include unexpected fields, such as the adult industry and travel providers.

Furniture stores, electronic shops, and online dating all carry higher risks, too – not to mention gambling ventures, MLMs (multi-level marketing), e-cigarettes/vapes, plus CBD & subscription services with recurring billing models.

How to search the best high risk merchant account service providers?

When selecting a high risk merchant account service provider, you must ensure the vendor accepts your business. Additionally, be mindful of fees, as higher rates are typically associated with this type of financial arrangement than those involving low-risk merchants.

When considering a high risk merchant account, it’s important to be aware of the associated fees and take proactive measures before you apply. Ensuring that your credit score is accurate and as good as can be will give you the best chance of getting an approved application.

Improve your merchant account approval chances by taking steps to bolster credit ratings. Make sure you are well-positioned for success with merchants in the future.

I hope you found everything related to high risk merchant account highriskpay.com and others. Now choose carefully for your businesses.